An error has occurred.

Please make sure you have a stable connection and try again.

An error has occurred.

Please make sure you have a stable connection and try again.

Sorry! You need an account to do that! Sign up now to get the most out of your MangaPlaza experience!

Already registered?

Sign up and get 10pt!

Popular Searches

Search by Genre

Reviews :

![]()

![]()

![]()

![]()

![]()

4.5 (2)

Genre :

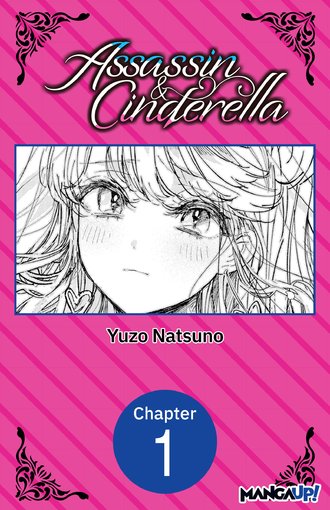

And so begins the story of the sweetest and deadliest couple in the world!

This title has 12 chapters.

Premium members enjoy a 10% point reward

with every purchase!

Reviews

Details

Page Count

Publisher Manga UP!

Color or Monochrome monochrome

Ongoing

Digital Release Date January 5, 2024 (PST)