An error has occurred.

Please make sure you have a stable connection and try again.

An error has occurred.

Please make sure you have a stable connection and try again.

Sorry! You need an account to do that! Sign up now to get the most out of your MangaPlaza experience!

Already registered?

Sign up and get 10pt!

Popular Searches

Search by Genre

Reviews :

![]()

![]()

![]()

![]()

![]()

1 (1)

Genre :

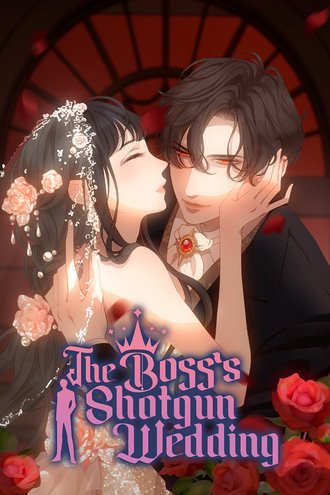

Gu Xixi's best friend tricks her into having a one-night stand with hot but standoffish Yin Sichen, the heir to a large corporation. As a result, she gets pregnant, loses her boyfriend, and has to leave her home. When Yin Sichen's family finds out, they force the two to marry. They don't love each other, but hopefully, with a little time and care, feelings will start to bloom...

This title has 535 chapters.

Premium members enjoy a 10% point reward

with every purchase!

Reviews

Overall:

![]()

![]()

![]()

![]()

![]()

1 (1 Reviews)

-

It's not good, but read this elsewhere & save $$$I'm sorry, but a story that treats SA as both a way to get someone to fall in love with you AND a way to punish someone else for their wrongdoings, is not a good story in my mind. Even so, I understand where some readers might get some really trashy fun out of this.

Which is why I'd say, to anyone who enjoys reading this, spend your money elsewhere. MangaPlaza is incredibly overpriced compared to other sources, whether you pay or not.

Save your cash, dive elsewhere for your trash. 0 Helpful

0 Helpful

Details

Page Count

Publisher Kuaikan Comics

Color or Monochrome color

Digital Release Date April 25, 2024 (PST)