An error has occurred.

Please make sure you have a stable connection and try again.

An error has occurred.

Please make sure you have a stable connection and try again.

Sorry! You need an account to do that! Sign up now to get the most out of your MangaPlaza experience!

Already registered?

Sign up and get 10pt!

Popular Searches

Search by Genre

Reviews :

![]()

![]()

![]()

![]()

![]()

5 (25)

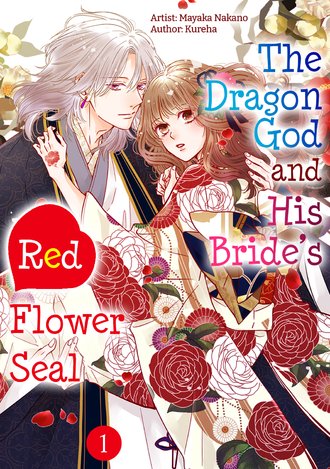

Mito is gifted with a birth-mark on her hand.

Legend says it's a blessing but in Mito's village it is told to be a sign of misfortune.

Mito is neglected by the villagers since birth with her family being discriminated all the same.

The only saving grace for her is time spent with a beautiful man who re-appears in her dreams.

This silver-haired man is actually one of the four God's that rule their universe?!

A love fantasy that defies time and space-!

Check out these special deals before they’re gone!

Only on MangaPlaza 10% Point Reward on Our Latest Titles!

This title has 5 chapters.

Premium members enjoy a 10% point reward

with every purchase!

Reviews

Details

Page Count 30 Pages

Publisher Starts Publishing Corporation

Color or Monochrome monochrome

Ongoing

Digital Release Date April 11, 2024 (PST)